views

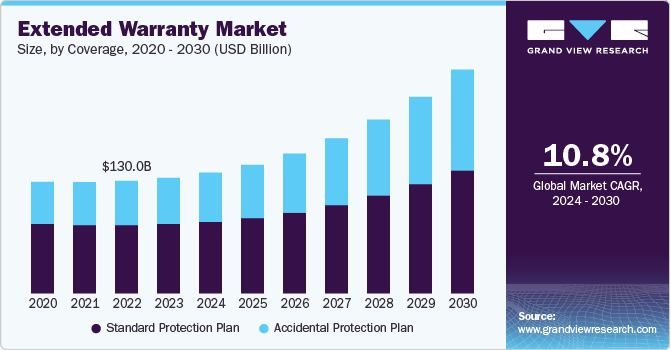

A safety net for our gadgets and gizmos is expanding across the globe. In 2023, the global extended warranty market was valued at USD 133.6 billion, and it's projected to grow at a brisk 10.8% CAGR from 2024 to 2030, largely fueled by the ever-increasing appetite for consumer electronics and home appliances. As smartphones, laptops, smart home devices, and kitchen appliances become more ubiquitous, the desire for extended protection beyond the manufacturer's standard guarantee has surged. These products often represent a significant outlay, and consumers seek the reassurance of coverage against unexpected repairs or replacements. With electronics becoming increasingly complex and susceptible to technical hiccups, peace of mind is driving the purchase of extended warranties.

More and more consumers are recognizing the value proposition of extended warranties. Savvier marketing by manufacturers, retailers, and third-party providers is educating consumers about the financial security these plans offer. The boom of e-commerce platforms has also made it seamless to bundle extended warranties with product purchases, further boosting their adoption. As consumers increasingly appreciate the protection of their investments, the uptake of extended warranties has steadily climbed.

The digital marketplace has become a fertile ground for the extended warranty market, offering providers greater avenues to connect directly with consumers. E-commerce platforms enable retailers to seamlessly offer extended warranties during the product purchase process, making it convenient for consumers to opt in. The rise of online comparison tools and platforms specializing in extended warranty products has also empowered consumers to make more informed choices about their coverage options.

Get a preview of the latest developments in the Extended Warranty Market; Download your FREE sample PDF copy today and explore key data and trends

Smart businesses are also recognizing extended warranties as a powerful tool for nurturing customer loyalty. By offering extended coverage, they forge an ongoing relationship with the customer, strengthening brand affinity. Many manufacturers and retailers are weaving warranties into loyalty programs or offering exclusive benefits to those who purchase extended protection. This focus on customer retention is particularly crucial in competitive markets, where holding onto customers can be a significant strategic advantage.

Detailed Segmentation

Coverage Insights

The standard protection plan segment accounted for the largest market share, over 60% in 2023. The surge in sales of mid-range electronics, appliances, and other consumer goods is a major driver of the standard protection plan segment. While premium products often come with more comprehensive warranty offers, mid-range products are usually come with standard protection plans. Consumers who purchase these items are more likely to seek protection that covers potential repairs, but they may not require the extensive coverage offered by more premium options.

Distribution Channel Insights

The manufacturers segment accounted for the largest market share of nearly 45% in 2023. The rising cost of repairs and replacements is compelling consumers to seek additional protection beyond standard manufacturer warranties. As products become more complex and technologically advanced, the potential for malfunctions increases, prompting consumers to invest in extended warranties

Application Insights

The consumer electronics segment accounted for the largest market share, over 33% in 2023. Many extended warranty providers now offer installment-based payment options or bundle warranty costs into device financing plans. This affordability and flexible payment structures make extended warranties more accessible to a broader range of consumers. For instance, instead of paying a large upfront sum, consumers can now include the warranty cost in their monthly device payments, reducing the immediate financial burden and increasing overall adoption.

End Use Insights

The individuals segment accounted for the largest market share, over 68% in 2023. Extended warranty providers are increasingly offering flexible payment plans, allowing individual consumers to spread out the warranty cost over time. For example, warranties are often bundled with installment-based purchasing, which makes it easier for consumers to include warranty protection without a large upfront expense.

Regional Insights

The extended warranty market in North America held a share of around 36% in 2023. The market in North America is characterized by high adoption rates across consumer electronics, automotive, and home appliances. Given the rising costs of repairs and replacements, consumers are increasingly seeking protection for high-value items such as smartphones, laptops, and vehicles. The surge in demand for expensive electronics and smart home devices has contributed to the popularity of extended warranties, as consumers aim to safeguard these purchases from potential damage or defects.

Key Extended Warranty Company Insights

Key players operating in the extended warranty market include Assurant, Inc., Asurion, American International Group, Inc., Endurance Warranty Services, LLC and AXA. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Extended Warranty Companies:

The following are the leading companies in the Extended Warranty market. These companies collectively hold the largest market share and dictate industry trends.

- American International Group, Inc.

- ASSURANT, INC

- Asurion

- AXA,

- CARCHEX, LLC

- Edel Assurance

- Endurance Warranty Services, LLC

- Liberty Mutual Insurance

- Likewize

- SquareTrade, Inc.

Extended Warranty Market Segmentation

Grand View Research has segmented the global extended warranty market report based on coverage, distribution channel, application, end use, and region.

- Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

- Standard Protection Plan

- Accidental Protection Plan

- Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Manufacturers

- Retailers

- Others

- Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Automobiles

- Consumer Electronics

- Home Appliances

- Mobile Devices and PCs

- Others

- End Use Outlook (Revenue, USD Billion, 2018 - 2030)

- Individuals

- Business

- Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Middle East & Africa

- U.A.E

- Kingdom of Saudi Arabia

- South Africa

Curious about the Extended Warranty Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Recent Developments

- In August 2024, Asurion partnered with Reach, a U.S.-based platform provider specializing in digital connectivity and mobile virtual network enabler (MVNE) solutions. This collaboration aims to offer seamless device protection and trade-in services to small and mid-sized regional operators. By integrating Asurion's services into Reach’s platform marketplace, the partnership provides operators with a valuable revenue stream. It enhances customer retention, streamlines the go-to-market process, and delivers a superior user experience.

- In July 2024, Assurant, Inc. partnered with HEVI Corp., a U.S.-based manufacturer specializing in all-electric heavy construction equipment. This collaboration allows HEVI customers to acquire an Assurant Extended Service Contract (ESC), which offers protection for their equipment beyond the standard manufacturer’s warranty period.

- In May 2023, Endurance Warranty Services, LLC expanded its range of auto protection offerings by introducing mechanical breakdown insurance (MBI) for residents of California. This new coverage provides California consumers with financial protection against expensive repairs resulting from unforeseen breakdowns or mechanical failures, ensuring they have the necessary support to safeguard their vehicles.

Comments

0 comment