views

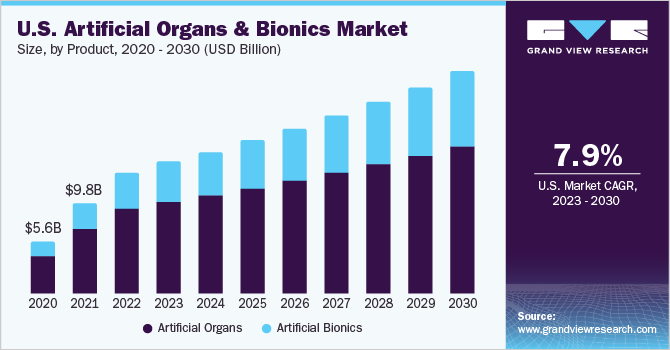

The science of healing is reaching new frontiers, where biology meets engineering to mend the human form. In 2022, the global artificial organs and bionics market was valued at USD 34.30 billion, and it's marching forward with a determined 9.3% CAGR projected from 2023 to 2030. The heart of this growth beats to the rhythm of increasing transplants coupled with a growing chorus of individuals awaiting the gift of life. In the U.S. alone, the Human Resource and Services Administration (HRSA) reported over 104,234 names on the national waiting list in 2023, with a new name added every ten minutes, underscoring the urgent need for artificial medical solutions.

The unprecedented health storm of the COVID-19 pandemic cast a temporary shadow over this landscape, disrupting medical procedures as healthcare systems grappled with the influx of coronavirus patients. The prioritization of COVID-19 care led to delays in elective surgeries, impacting the adoption of devices like orthopedic bionics, often crucial post-amputation. However, as the world adapted and restrictions eased, the market is poised to regain its momentum and flourish in the forecast period.

Get a preview of the latest developments in the Artificial Organs And Bionics Market; Download your FREE sample PDF copy today and explore key data and trends.

Organ failure, stemming from critical events like blood loss, substance abuse, severe trauma, and acute illnesses, underscores the necessity for these innovations. Furthermore, the toll of modern lifestyles – unhealthy diets, smoking, excessive alcohol, and lack of exercise – further compromises organ function. Yet, progress in healthcare facilities and the increasing availability of advanced artificial support systems are expected to amplify the demand for these life-enhancing technologies.

The rising tide of the global geriatric population is a significant driver, creating increasing demand for organ implants. The number of individuals over 65 seeking and receiving organ transplants is on the rise, with this demographic often exhibiting the highest need for artificial devices due to increased susceptibility to post-transplant complications. HRSA data reveals that in 2022, 8,895 organ transplant procedures were performed on those over 65 in the U.S. In the same year, a total of 42,887 organ transplants were performed nationwide, marking a 3.7 percent increase from 2021. Thus, longer lifespans and the persistent need for organ donors are fueling the demand for artificial solutions.

Looking ahead, studies predict a continued rise in the organ transplant waitlist. In response, HRSA announced the OPTN Modernization Initiative in March 2023, aiming to enhance system fairness, accountability, and performance through advancements in technology, data transparency, governance, operations, and quality improvement.

The emergence of 3D bioprinting is proving to be a game-changer in organ transplantation, offering a pathway to create artificial organs with a minimized risk of rejection. Furthermore, artificial intelligence is poised to revolutionize the landscape of artificial devices. Current efforts are focused on developing AI-powered tools that provide customized assessments of organ and donor suitability, promising to enhance decision-making in organ retrieval and empower patients in choosing the best path forward.

Detailed Segmentation

Product Insights

The artificial organs segment dominated the market with the largest revenue share of 70.4% in 2022. Demand for kidney, heart, lung, and liver transplants is contributing to the growth of the segment. The average median waiting time to transplant a kidney in the U.S. is 5 years. Many factors are considered while on the waiting list, such as body size, blood type, distance from a donor, and severity of illness. Thus, the challenge of fulfilling unmet demand has compelled the manufacturers to develop bio-lungs, artificial pancreas, and wearable artificial kidneys.

Technology Insights

The mechanical segment dominated the market with the largest revenue share of 66.9% in 2022. This is primarily attributed to the rising incidence of organ failure and the low cost of mechanical bionics. A mechanical artificial heart valve lasts much longer as compared to the other options, creating a robust demand. Other factors contributing to the growth are speedy FDA approvals and reimbursement policies. For instance, in September 2021, the FDA approved Abbott's Portico with FlexNav TAVR system to treat individuals with symptomatic and aortic stenosis who may be at high or very high risk for open-heart surgery.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 45.0% in 2022. The reason for this growth is the increase in transplant surgeries and the need for artificial organs due to the high incidence of organ failure. Furthermore, the presence of well-developed healthcare facilities and the local presence of many large biotechnology and medical device companies, such as Zimmer Biomet, Arthrex, Inc., Medtronic, Novartis AG, and Stryker, contribute to its dominance. For instance, in March 2022, Zimmer Biomet Holdings, Inc. announced the launch of WalkAI, an evolving AI design that recognizes patients who are expected to have a lesser gait speed outcome, ninety days after hip or knee surgical intervention. WalkAI augments ZBEdge, a suite of integrated smart, robotic technologies digitally designed to offer transformative data-powered clinical insights to boost patient outcomes, with strong predictive analytic capabilities. The number of donors in the U.S. has increased significantly in the last 5 years. According to the U.S. Department of Health and Human Services, there was a 27.7% increase in the number of organ donors from 2015 to 2019. The growing demand for kidney transplantation is one of the major drivers of the market for artificial organs and bionics. Kidney transplantation witnessed an exponential growth from 16,186 transplants in 2011 to 23,401 transplants in 2019 and 24,670 in 2021.

Key Artificial Organs And Bionics Companies:

The following are the leading companies in the Artificial Organs And Bionics Market. These companies collectively hold the largest market share and dictate industry trends.

Artificial Organs And Bionics Market Segmentation

Grand View Research has segmented the global Artificial Organs And Bionics market based on component, deployment, application, and region:

- ABIOMED

- Berlin Heart

- Zimmer Biomet

- Boston Scientific Corporation

- Cochlear Ltd.

- Edwards Lifesciences Corporation

- Ekso Bionics

- Medtronic

- Jarvik Heart, Inc

- SynCardia Systems, LLC

Artificial Organs And Bionics Market Segmentation

Grand View Research has segmented the global artificial organ and bionics market based on product, technology, and region:

Artificial Organs & Bionics Product Outlook (Revenue, USD Million, 2018 - 2030)

- Artificial Organs

- Artificial Bionics

Artificial Organs & Bionics Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Mechanical bionics

- Electronic bionics

Artificial Organs & Bionics Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- Australia

- Thailand

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Curious about the Artificial Organs And Bionics Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

Comments

0 comment